In the Silmarillion, in a section entitled “Ainulindalë,” J.R.R. Tolkien has the Creator Eru Ilúvatar make the “Ainur” as the offspring of his thoughts, what we might call “angels.” [1] These angelic beings have been given gifts of reason, harmony, and freedom. At the beginning of time, Eru Ilúvatar teaches them how to sing. Initially, they sing in harmony as Eru Ilúvatar reveals the “Great Music.” The Great Music is lovely and has a theme of deep harmony and beauty. Unfortunately, Melkor, the most powerful of the Ainur, begins to sing louder and differently than the others in hopes of increasing his importance.

In the Silmarillion, in a section entitled “Ainulindalë,” J.R.R. Tolkien has the Creator Eru Ilúvatar make the “Ainur” as the offspring of his thoughts, what we might call “angels.” [1] These angelic beings have been given gifts of reason, harmony, and freedom. At the beginning of time, Eru Ilúvatar teaches them how to sing. Initially, they sing in harmony as Eru Ilúvatar reveals the “Great Music.” The Great Music is lovely and has a theme of deep harmony and beauty. Unfortunately, Melkor, the most powerful of the Ainur, begins to sing louder and differently than the others in hopes of increasing his importance.

This music introduced discordance into the music—a discordance that grows and becomes ultimately repetitive and violent. Ilúvatar finally arises and tells the Ainur: “No theme may be played that hath not its uttermost source in me, nor can any alter the music in my despite.” [2] He then shows the Ainur the result of their music: the World amid the Void. To their surprise, the Ainur discover that by singing their melodies, they have created a habitation for the children of Ilúvatar, elves, and men, who were not present in the original theme. Finally, the Creator says, “Eä! Let these things Be!” and gives life to the model that the choir of the Ainur has shaped. [3] Thus, the history of Tolkien’s imaginary world begins.

Both Tolkien and C. S. Lewis developed creation mythologies that have musical themes. [4] One might think that this is accidental, but I think otherwise. Both were university professors, and both were probably familiar to at least some degree with both ancient Platonic philosophy and the discoveries of modern physics. Those familiar with this blog know that I believe the findings of contemporary physics have increasingly superseded a worldview we have accepted for 300 years and perhaps return us to a more classical worldview. Unfortunately, these discoveries have not yet informed our daily lives and the decision-making capacities of our leaders.

Physics and a Harmonic Universe

The beginning of the 20th century saw a revolution in physics as Relativity Theory replaced the Newtonian notions of Absolute Time and Space, and Quantum Physics developed a view of reality at odds with Newtonian materialism. From a physical perspective, quantum physics indicates that the ultimate reality (the “ultimate being” from a scientific point of view) is that particles are not material bodies but disturbances in a universal field. There are even physicists who believe that a fundamental reality is information. In the words of John Wheeler, “The ‘it’ is a’ bit’.” [5] However, fundamental reality is to be visualized, science no longer supports a purely materialistic approach to solving problems because reality is not fundamentally material.

By the 1020s, the mathematician and philosopher Alfred North Whitehead recognized that matter, atoms, and subatomic particles of whatever kind were not matter. Rather, they appeared to be what Whitehead calls “patterns” or “vibrations” in a universal electromagnetic field, an emerging disturbance in an underlying field of potentiality. [6]

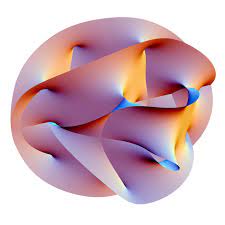

The idea of reality as being ultimately composed of patterns or vibrations almost automatically introduced the concept of harmonics into physics and metaphysics. This development was given additional emphasis by the development of what is called “String Theory.” Now, the “strings” of string theory are not physical strings like the strings of a guitar. They are one-dimensional objects existing in what physicists call “Hilbert Space.” The harmonics of these strings are not musical but mathematical. Not all physicists buy into string theory or the musical metaphor often used to support it. Furthermore, many quasi-New Age blather can be found on the internet using string theory to support musical explanations of the world that are themselves metaphors built upon a metaphor. Not much of it has a scientific basis.

The idea of reality as being ultimately composed of patterns or vibrations almost automatically introduced the concept of harmonics into physics and metaphysics. This development was given additional emphasis by the development of what is called “String Theory.” Now, the “strings” of string theory are not physical strings like the strings of a guitar. They are one-dimensional objects existing in what physicists call “Hilbert Space.” The harmonics of these strings are not musical but mathematical. Not all physicists buy into string theory or the musical metaphor often used to support it. Furthermore, many quasi-New Age blather can be found on the internet using string theory to support musical explanations of the world that are themselves metaphors built upon a metaphor. Not much of it has a scientific basis.

And yet….

Edward Whitten, a professor of physics and mathematical physicist at the Institute for Advanced Study in Princeton, New Jersey, described String theory as follows:

String theory is an attempt at a deeper description of nature by thinking of an elementary particle not as a little point but as a little loop of vibrating string. One of the basic things about a string is that it can vibrate in many different shapes or forms, which gives music its beauty. If we listen to a tuning fork, it sounds harsh to the human ear. And that’s because you hear a pure tone rather than the higher overtones that you get from a piano or violin that give music its richness and beauty.

So in the case of one of these strings it can oscillate in many different forms—analogously to the overtones of a piano string. And those different forms of vibration are interpreted as different elementary particles: quarks, electrons, photons. All are different forms of vibration of the same basic string. Unity of the different forces and particles is achieved because they all come from different kinds of vibrations of the same basic string. [7]

One of the proponents of the metaphor of music and string theory wrote recently:

That the world around us possesses musical attributes has been a preferred theme of philosophers and mystics since the early days of Western culture. The relationship has also been emphasized by highly regarded scientists, from Johannes Kepler, in the seventeenth century, to Edward Witten…. However, the exact nature of this relationship has been subjected to different interpretations through the centuries. For example, the mystical stance sustained by Pythagoras more than two millennia ago, concerning a musical universe, diverges substantially from that proposed by contemporary string theorists. Thus, even though string theorists claim, as many before them did, that their physical universe has something to do with music, their association is unique. It cannot be reduced to previous conceptions. [8]

This quotation shows that those who use a musical metaphor in connection with string theory are part of a long tradition recognizing the importance of music and its metaphorical application and explanatory power in various contexts.

A Pythagorean Interpretation of Reality

Those who support the harmonic interpretation of the universe normally begin with the thought of Pythagoras. According to Pythagoras, celestial music permeates the universe, which corresponds to a mathematical harmony. Pythagoras noticed the harmonious movements of the heavens and other harmonies that gave rise to his mystical, even religious belief in a harmonic universe. We human beings participate in their harmonic universe and can create discord in the universe as the divine harmony is warped by human behavior.

Pythagoras deeply influenced Plato. In the last part of the Republic, Plato introduced his own harmonious theory of the creation of the universe. [9] Specifically, Plato’s musical theory was both mathematical and idealistic. The musical harmony of the universe was an eternal and changeless reality in a world of pure thought, the world of the forms. For Johannes Kepler (1571-1630), a founder of modern science, there was an element of harmony between music and the universe. Kepler believed the universe was imbued with rational thought, a harmonic, though inaudible, music. Thus, Kepler believed the planets move in a mathematical cosmic harmony. For him, the idea of musical harmony of creation was not a metaphor. In his view, the universe’s harmony reflects the Trinity’s harmony. [10]

This notion of a harmonic connection to reality was not accidentally or idiosyncratically imported into physics; many of the founders of modern physics, from Einstein on, were musical and interested in music. [11] Brian Green, author of The Elegant Universe, has written:

Music has long since provided the metaphors of choice for those puzzling over questions of cosmic concern. From the ancient Pythagorean “music of the spheres” to the “harmonies of nature” that have guided inquiry through the ages, we have collectively sought the song of nature in the gentle wanderings of celestial bodies and the riotous fulminations of subatomic particles. With the discovery of superstring theory, musical metaphors take on a startling reality, for the theory suggests that the microscopic landscape is suffused with tiny strings whose vibrational patterns orchestrate the evolution of the cosmos. The winds of change, according to superstring theory, gust through an aeolian universe. [12]

Conclusion

Augustine quotes Cicero speaking through the voice of Scipio using a musical analogy as follows:

In the case of music for strings or wind, and in vocal music, there is a certain harmony to be kept between the different parts, and if this is altered or disorganized the cultivated ear finds it intolerable; and the united efforts of dissimilar voices are blended into harmony by the exercise of restraint. In the same way, a community of different classes, high, low, and middle, unites, like the varying sounds of music, to form a harmony of the different parts through the exercise of rational restraint, and what is called harmony in music answers to concord in a community, and is the closest bond of security in a country. And this is not possible without justice. [13]

Social harmony requires social justice, and social justice is created when all the various components of society find their proper place and receive their due reward in a social concord that allows the society to prosper. This goes classes to include all of the elements of a functional society.

The idea that human society and ideals, such as justice, reflect a “bias for harmony” that is part of the created order intrigues me. Most of the time, the adjustments we make in societies, from the family onward, have to do with restoring or creating harmony in the social system. The metaphor of music that was attractive to Cicero and Augustine and the meditations of philosophers from Pythagoras and Plato onward lead some credence to this notion. In addition, the idea of harmonics is part of a greater theory of morality and ideals as related to aesthetics, a concept that many people find attractive. The idea that the universe is somehow harmonic is worth exploring. If it is true, it is obvious that we humans are part of that harmonic universe.

The idea of harmony as being fundamental to reality comports with the notion that a sound social order is characterized by what the Jews called “Shalom” and what we often call “Peace.” Whatever one may say about the condition of modern society, and perhaps particularly Western society, there is a distinct lack of Shalom. Perhaps a concentration of rebuilding social harmony, as opposed to the politics of division and hate, would be a nice idea.

Copyright 2023, G, Christopher Scruggs, All Rights Reserved

[1] J. R. R. Tolkien, The Silmarillion (Boston, MA: Houghlin Mifflin, 1977).

[2] Id, at 17.

[3] This introduction was suggested to me by Andrej Strocaŭ, “The Music of Creation in Tolkien andLewis” in The Wheel (2021) found at https://static1.squarespace.com/static/54d0df1ee4b036ef1e44b144/t/608ec56a38080d367214e447/1619969387589/04_Strocau.pdf (Downloaded September 25, 2023).

[4] For Lewis, the analogy is found in his work, The Magicians Nephew which has been published as a part of the Narnia Series. C. S. Lewis, The Magicians Nephew (New York, NY HarperCollins; Reprint edition (March 5, 2002).

[5] See, Paul Davies, Niels Henrik Gregerse, Information and the Nature of Reality – From Physics to Metaphysics (Cambridge, UK: Cambridge University Press, 2011). The term was coined by renowned physicist John Wheeler.

[6] A.N. Whitehead, Science and the Modern World (New York, NY: Free Press, 1925, 1967), at 132.

[7] Nova, The Elegant Universe “An Interview with Edward Witten” at https://www.pbs.org/wgbh/nova/elegant/view-witten.html (downloaded September 25, 2023). At this point, I must reveal that my mathematical abilities are not sufficient to understand String Theory in depth nor to understand fully its defenders and opponents.

[8] “The Music of Superstrings” Part I of IV at http://spinningthesuperweb.blogspot.com/2008/04/2-music-of-superstrings-i.html (downloaded September 25, 2023).

[9] One sad aspect of contemporary education is that contemporary students, unlike C. S. Lewis, and J.R.R. Tolkien, do not study the classics. In my time, the study of the classics had fallen out of most academic curricula. I believe that the mathematical and musical interpretation of creation, suggested by their mythology, was deeply influenced by their familiarity with classical literature, especially Plato.

[10] “The Music of Superstrings” Part II of V.

[11] Id, at III of V.

[12] Michael Greene, The Elegant Universe 2nd Rev. Ed (New York, W.W. Norton Company, 2003).

[13] Cicero, On the Commonwealth tr. George Holland Sabine & Stanley Barney Library of the Liberal Arts, ed. (Indianapolis, IN: Bobbs-Merrill Company, Inc., 1929), 183. Augustine studied and appreciated Cicero.